This Ruzeng.com Review evaluates the platform’s credibility and risk profile using a structured risk assessment approach. Ruzeng.com is presented as a cryptocurrency wallet or storage service, yet available domain and reputational data raise significant transparency and accountability concerns.

Created on 2025-10-21 (October 21, 2025).

A newly registered domain with privacy-protected ownership often limits the ability to verify operational history or assess long-term user outcomes. While new platforms can operate legitimately, short domain age in the crypto services category — especially with limited supporting documentation — increases counterparty risk and uncertainty for users evaluating fund custody services.

The core question for users considering Ruzeng.com is not only what the platform claims to offer — but whether those claims can be independently verified and backed by transparent operator documentation.

Branding and Service Claims Risk

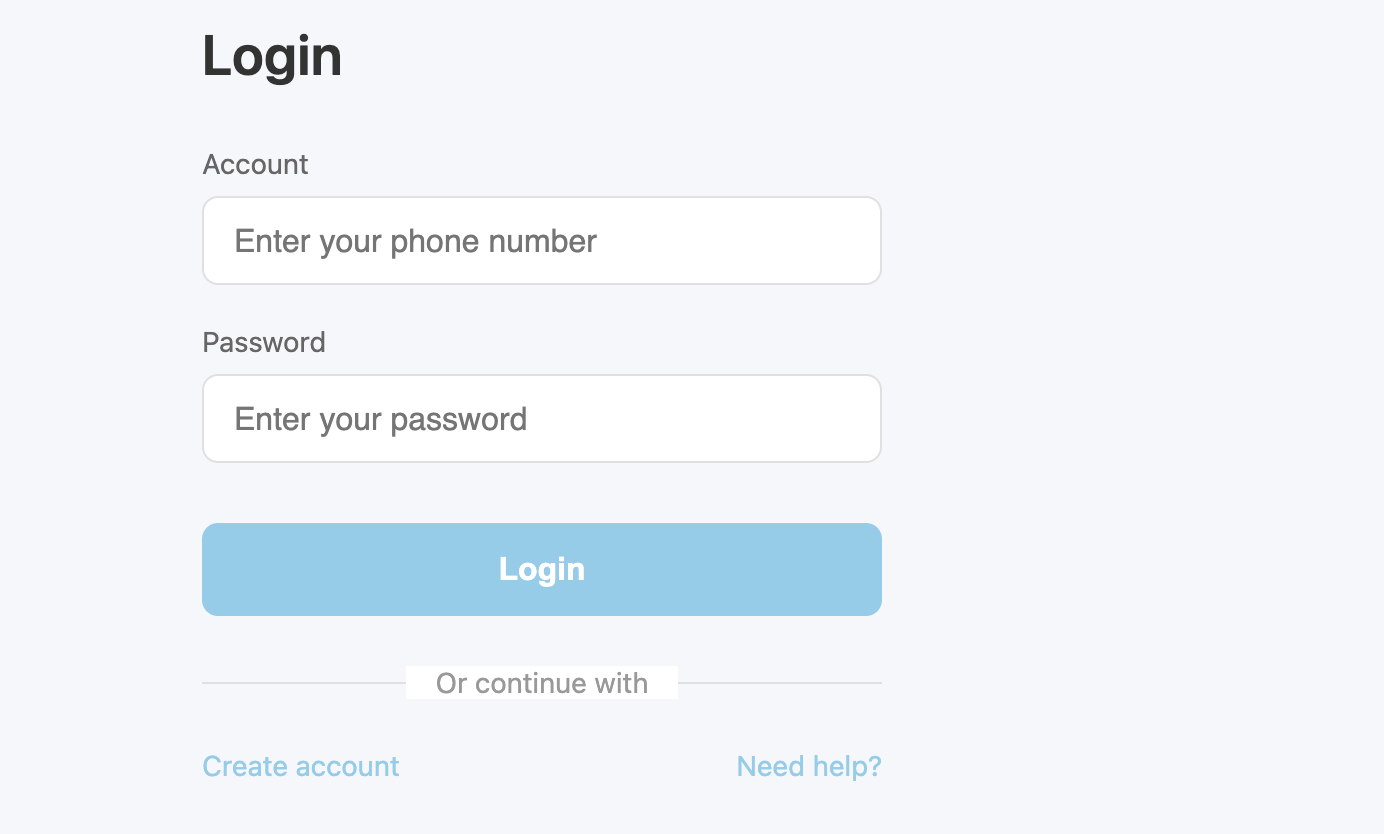

Ruzeng.com is often listed in regional trust scoring and website reputation tools as a cryptocurrency wallet or storage service, typically involving a login interface and minimal publicly visible service explanation.

Cryptocurrency wallets that manage private keys, custody funds, or facilitate transactions should uphold robust transparency measures. That includes:

-

Publicly verifiable corporate identity

-

Detailed terms of service and privacy disclosure

-

Clear custody and security protocols

-

Independent audit reports

When such disclosures are absent or limited, risk increases because users cannot independently evaluate how funds are stored, controlled, or protected.

Ownership and Accountability Gaps

A key structural concern in this Ruzeng.com Review is the lack of easily accessible ownership identity. Domains that use privacy protection in WHOIS entries reduce traceability, which in itself isn’t conclusive proof of wrongdoing, but it does reduce accountability.

For financial platforms, especially those handling sensitive asset custody functions, transparent ownership documentation is critical. Users need clarity on who is responsible for operational decisions, dispute handling, and custodial liabilities.

Without publicly verifiable corporate registration or responsible party disclosure, users face elevated counterparty risk.

Technical and UX Structural Signals

Analysis from independent website reputation tools highlights several risk markers for Ruzeng.com:

-

Very recent domain age (less than six months).

-

Limited visible content beyond a login page.

-

Absence of detailed terms of service or risk disclosures.

-

Minimal third-party validation of operations.

These signals, combined with limited transparency, suggest that users should proceed with extreme caution and avoid entering sensitive credentials or funds until further verification is available.

Custody and Security Risk

True cryptocurrency wallets — whether custodial or non-custodial — must distinguish themselves with:

-

Public documentation of how private keys are managed

-

Whether they are custodial (holding keys for users) or non-custodial

-

Independent security audits and proof-of-reserve mechanisms

-

Clear threat models and breach response procedures

When a platform fails to disclose custody arrangements and security architecture, users may unknowingly expose themselves to phishing, credential harvesting, or unauthorized access. Minimal content and a basic login interface can be structural markers of phishing-style deployment.

Regulatory and Licensing Exposure

Another key risk category in this Ruzeng.com Review is regulatory uncertainty. Legitimate crypto custody services typically operate under some form of oversight or at least provide transparent corporate and jurisdictional information.

Without verifiable licensing or registered entity disclosure, users are exposed to offshore broker risk and limited formal dispute resolution avenues. While not all crypto wallet services require formal regulation, transparency around governance, financial safeguards, and compliance remains a strong credibility signal.

Prospective users should always verify any regulatory claims through official public registers before engaging with a platform that handles cryptocurrency assets.

Practical User Safety Measures

If you encounter platforms like Ruzeng.com, consider these positions to reduce exposure:

-

Avoid storing large balances: Until legitimacy is verified, keep funds only in wallets you fully control.

-

Verify ownership and licensing: Look for registered corporate documentation and transparent escalations.

-

Check for independent audits: Security audit reports from reputable firms add credibility.

-

Preserve all communications: If suspicious behavior emerges, documentation supports reporting and potential recovery pathways.

These measures help mitigate exposure to phishing, credential compromise, and unregulated wallet risk.

Overall Risk Assessment

Based on the domain’s short operational history, privacy-protected ownership, minimal transparency, and lack of independently verifiable documentation, the Ruzeng.com Review classifies the platform as high risk for users seeking secure cryptocurrency custody or wallet services.

While no single factor proves fraudulent intent, the combined structural indicators align with patterns observed in phishing sites and unregulated crypto platforms that expose users to elevated risk.

Users should treat the absence of transparent documentation and verifiable safeguards as a significant risk signal.

Report the Scam

➡️ https://www.reportcoinscams.com/book-a-consultation/

If you have experienced credential compromise, unexpected account behavior, or suspicious activity linked to Ruzeng.com, preserve all logs and communications before seeking guidance.