Keyfund.net presents itself as an online investment service, potentially offering opportunities in asset growth, wealth management, or financial markets exposure. Although marketing language may sound professional, the platform’s limited operational history and lack of verifiable trust signals raise important questions about credibility and safety.

This Keyfund.net review adopts a risk breakdown tone, examining domain age, transparency risk, regulatory exposure, reputation footprint, and structural red flags that investors should consider before engaging with the platform.

Domain History and Registration Details

Created on 2025-10-29

According to domain age estimators and reputation scanning tools, Keyfund.net was registered on October 29, 2025 and has a relatively short operational history. A recently created domain in the financial services space makes it difficult for users to assess long-term legitimacy, consistency, or community trust.

While a new domain does not automatically indicate fraud, limited historical presence increases uncertainty, especially if there are minimal independent references and no established track record of performance or compliance.

Risk Category 1: Transparency Risk

Transparency is a key foundational element of platform trust. In evaluating Keyfund.net, the following gaps in transparency become apparent:

-

No clearly disclosed corporate registration

-

No identifiable business address

-

No leadership or management disclosures

-

Absence of publicly verifiable legal documentation

Legitimate financial or investment services usually publish registered business information, legal terms of service, audited reports, and compliance documentation. The absence of such disclosures increases counterparty risk — the possibility that the platform cannot be held accountable in a dispute.

Risk Category 2: Regulatory Exposure

One of the most important safety factors for any investment platform is its regulatory status. Licensed platforms typically operate under one or more financial regulators, such as:

-

U.K. Financial Conduct Authority (FCA)

-

U.S. Securities and Exchange Commission (SEC)

-

Australian Securities and Investments Commission (ASIC)

-

Cyprus Securities and Exchange Commission (CySEC)

There is no public evidence that Keyfund.net operates under a recognized regulatory authority. The lack of transparent regulatory oversight raises unregulated broker risk, meaning there may be no legal protections or compensation schemes for users if issues arise.

Investors can verify licensing by checking official regulator databases such as those at https://www.sec.gov.

Risk Category 3: Reputation Footprint

An important component of risk analysis is the independent reputation footprint of a platform. For Keyfund.net, reputation indicators are weak or non-existent:

-

Minimal presence on reputable review platforms

-

Lack of verified user experiences

-

No significant independent media coverage

-

Absence of discussion on financial or trading forums

A strong reputation footprint typically includes verified user feedback, third-party coverage, and community engagement over time. Keyfund.net’s lack of these signals increases uncertainty about its credibility.

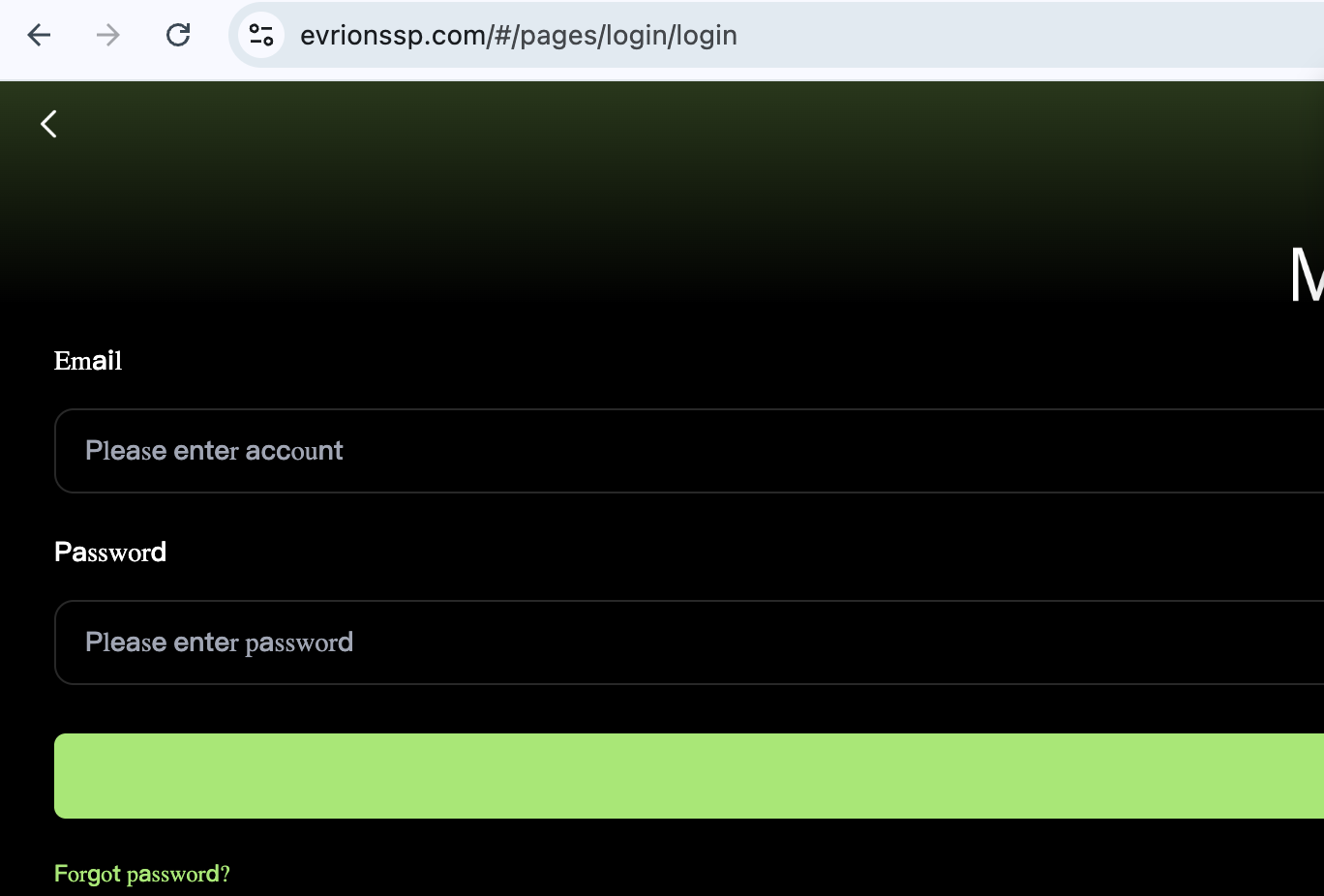

Risk Category 4: Service Clarity and Operational Risk

The clarity of how a platform delivers its services is crucial for evaluating risk. Available public information for Keyfund.net does not clearly communicate:

-

The specific investment products offered

-

How funds are managed and held

-

Fee and payout structures

-

Withdrawal procedures and timelines

-

Custody and security protocols for user funds

Unclear service mechanics create operational risk, where users may encounter unexpected fees, blocked withdrawals, or misunderstandings about how the platform functions.

Financial platforms that do not clearly outline their trading, investment, or payout processes significantly increase user risk exposure.

Overall Risk Assessment

This Keyfund.net review highlights multiple risk factors that together create a high-risk profile:

-

Short operational history with limited domain age

-

Transparency gaps in business and legal disclosures

-

No visible regulatory licensing or oversight

-

Weak independent reputation footprint

-

Unclear service mechanics and operational protocols

Individually, these risk signals warrant caution. Combined, they place Keyfund.net in a higher-risk category compared to regulated and established financial service providers.

Users considering engagement with any financial or investment platform should conduct independent due diligence, confirm licensing through credible regulators, and verify user feedback from trusted sources before depositing funds or sharing sensitive information.

Report the Scam

➡️ https://www.reportcoinscams.com/book-a-consultation/

If you believe you have encountered misleading practices, financial irregularities, or withdrawal issues while interacting with Keyfund.net, it is important to document all communications and transaction records promptly.