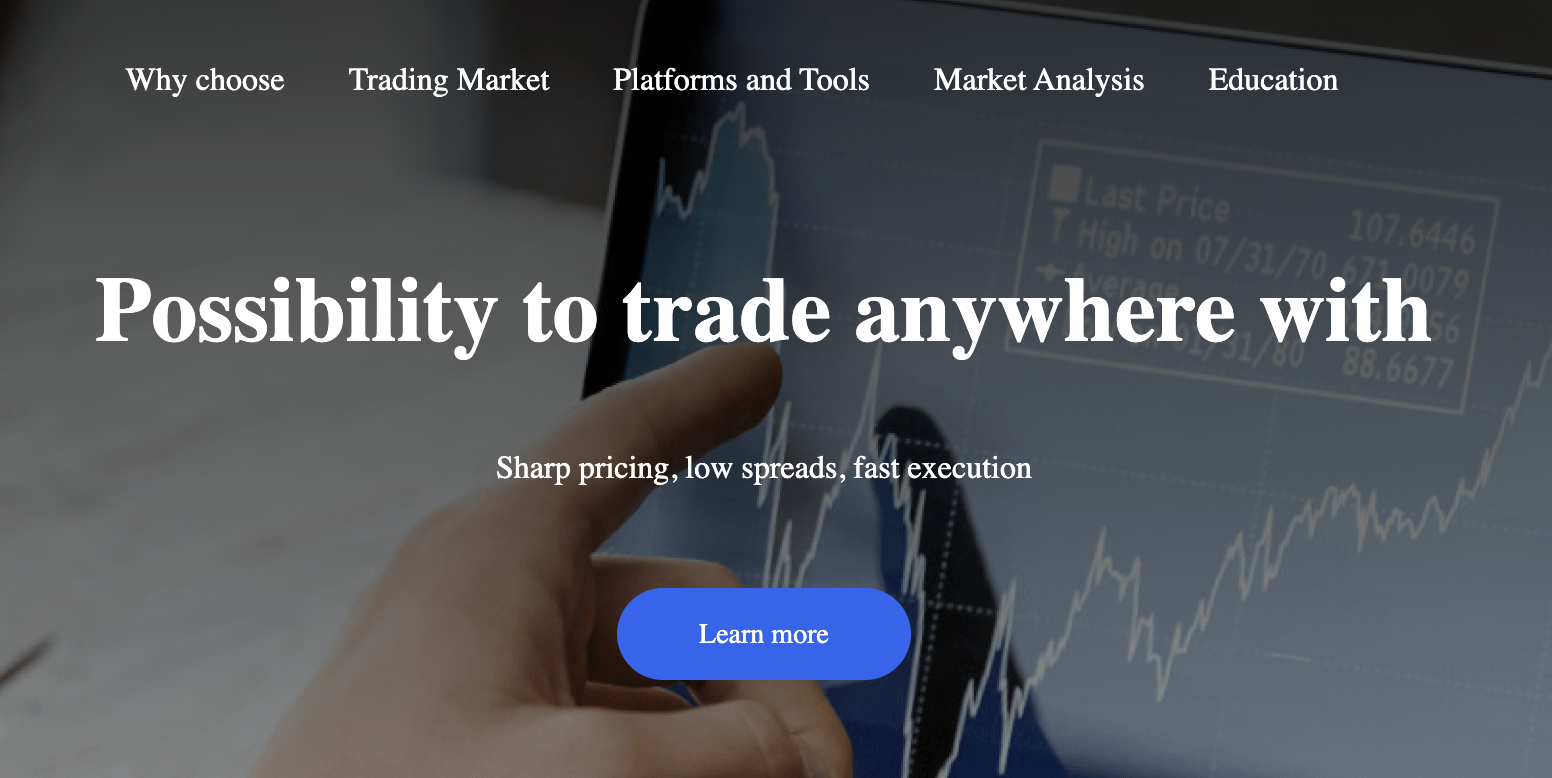

Gs-base.com positions itself online as a crypto trading and exchange platform, styled to resemble trusted brands like Coinbase. Clone branding — where a site mimics the look or language of real exchanges — is a common tactic in crypto scams designed to lure users into a false sense of security.

This Gs-base.com review applies a risk breakdown approach, analyzing domain history, transparency risk, regulatory exposure, reputation footprint, and service mechanics risk to help you assess whether this platform is safe or potentially fraudulent.

Domain History and Registration Details

Created on 2025-11-20

According to domain age estimators and reputation tools, Gs-base.com was registered on November 20, 2025, making it a very recently created web property with virtually no historical track record. New domains in the crypto space should be treated with caution because:

-

There is no long-term performance data.

SCAM ALERT – DON’T MISS THIS 👉 Eliteinvestmentpro.one: Is it a Safe Platform? -

No established history of withdrawals or user accountability exists.

-

Scam operations frequently use fresh domains to avoid long-term scrutiny.

Short domain age in financial or crypto services increases operational uncertainty because legitimate exchanges typically build presence over years.

Risk Category 1: Transparency Risk

Transparency is one of the most important risk categories for financial services. In this Gs-base.com review, several transparency concerns are apparent:

-

No clear corporate registration is publicly disclosed.

-

Ownership and management identities cannot be verified.

-

Legal terms of service and privacy documentation are vague or lacking.

-

No verifiable address or contact information is provided.

Legitimate exchanges always publish clear corporate identity, legal terms, and compliance details. Lack of transparency here increases counterparty risk, where a user has no clear counterpart in case of disputes.

Risk Category 2: Regulatory Exposure

Trusted crypto exchanges operate under regulatory oversight in at least one jurisdiction. This includes supervision by deposit and investor protection authorities such as:

-

U.S. Securities and Exchange Commission (SEC)

-

U.K. Financial Conduct Authority (FCA)

-

European regulators (ESMA & national bodies)

In this review, there is no credible evidence that Gs-base.com is regulated by any recognized financial authority. Operating without transparent licenses exposes users to:

-

Unknown legal protections

-

No formal dispute resolution processes

-

Potential regulatory violations

Regulatory oversight matters because it enforces consumer protection and trust safeguards — levels of protection that may be absent here.

Investors can independently confirm licensing by checking official regulator registers like https://www.sec.gov.

Risk Category 3: Reputation Footprint

Evaluating reputation is key to understanding real-world user experiences and independent credibility signals. For Gs-base.com:

-

Independent reputation tools assign a very low trust score

-

No meaningful verified reviews exist on established platforms

-

No presence on recognized crypto community forums

-

No authoritative media mentions or expert evaluations

Low or nonexistent reputation footprint leads to reputation risk, where users lack independent insights into whether others have safely used the platform.

Credible exchanges generate organic discussion across platforms like Reddit, Trustpilot, or crypto news outlets — signals that are missing here.

Risk Category 4: Service Mechanics & Technical Clarity

A key part of assessing any trading or exchange service is clarity on how it functions, including:

-

Wallet custody and fund storage

-

Fee structures and transaction costs

-

Order execution mechanics

-

Withdrawal terms and timelines

-

Security protocols (e.g., 2FA, cold storage)

For Gs-base.com, service mechanics are unclear or not verifiable:

-

No documented custody or security protocol details

-

Fee structure and trading terms are not transparently explained

-

Withdrawal mechanics are not backed by independent evidence

-

Minimal public disclosures on platform infrastructure

Lack of documented operational mechanics creates service ambiguity risk, where users may encounter unexpected terms, fee disputes, or withdrawal problems.

Risk Category 5: Clone Branding and Deceptive Presentation

The name “Gs-base” and the site’s styling appear to evoke familiarity with well-known platforms like Coinbase. Using clone-style branding is a known tactic in scam operations because:

-

Users may assume legitimacy by association

-

Brand familiarity reduces initial skepticism

-

Attackers leverage the goodwill of established firms

Clone sites often attract deposits by creating a false sense of security. Users should never assume legitimacy based on design cues alone — real regulatory and reputation signals must be verified independently.

Overall Risk Assessment

This Gs-base.com review consolidates key risk signals:

-

Very short domain age with no track record

-

Significant transparency gaps in ownership and legal terms

-

No verifiable regulatory licensing

-

Minimal independent reputation or user feedback

-

Unclear service mechanics

-

Clone-style branding risk

Taken together, these factors place Gs-base.com in a high-risk category relative to established and regulated crypto exchanges. Users should exercise extreme caution before entering any financial information or depositing funds.

Report the Scam

➡️ https://www.reportcoinscams.com/book-a-consultation/

If you believe you have encountered misleading practices, suspicious operations, or adverse outcomes while interacting with Gs-base.com, document all communications and transaction records as soon as possible.