This Lion-miner.com Review examines the platform’s credibility and risk profile from a structured risk assessment perspective. Lion-miner.com presents itself as a cryptocurrency mining service. However, available data points raise significant concerns about transparency, legitimacy, and user protection.

Created on 2025-11-11 (November 2025).

A domain that is very recently registered with minimal public track record significantly limits the ability to assess operational stability, withdrawal reliability, or verified user outcomes. In crypto mining and investment environments, short domain age is a common risk marker, especially when other transparency signals are weak or absent.

The platform’s branding and marketing language emphasize earning potential rather than verifiable mining infrastructure details. A responsible mining service should provide transparent information about hardware, mining pools, energy costs, and independent performance verification. The absence of such details creates uncertainty around the core value proposition.

Lack of Regulatory Licensing and Oversight

A central concern in this Lion-miner.com Review is the absence of confirmed licensing or regulatory oversight.

Legitimate financial service providers — particularly those collecting funds or offering profit-sharing schemes — typically provide verifiable registration with recognized authorities. When a service operates without verifiable licensing or clear jurisdictional oversight, users are exposed to offshore broker risk and limited formal recourse channels.

Regulatory bodies like the Securities and Exchange Commission (SEC), Financial Conduct Authority (FCA), and Australian Securities and Investments Commission (ASIC) exist to enforce compliance standards and protect investors. Operating outside these oversight frameworks increases exposure to unregulated financial service risk.

Promotional Claims and Mining Transparency

Mining services should clearly articulate their infrastructure:

• Where the mining hardware is located

• Which mining pools the service participates in

• How hashrate is allocated

• What fees are charged and how they are calculated

• Independent validation of output

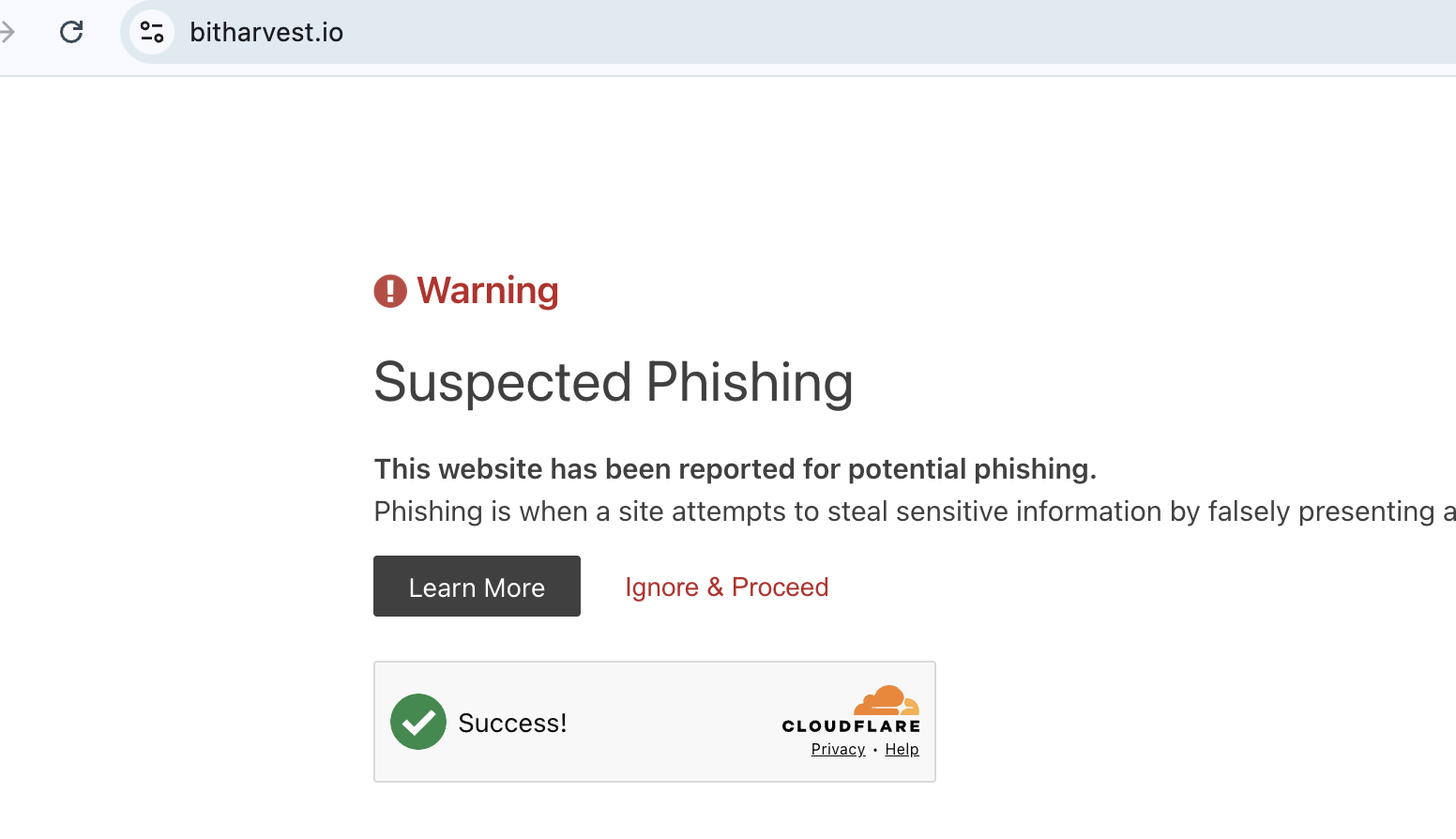

Lion-miner.com’s promotional messaging revolves around “high returns,” “smart mining rewards,” or similar value propositions without evident independent verification. Platforms that emphasize returns while providing few operational details often replicate promotional mechanics used by high-yield scheme models.

This lack of transparency extends users’ dependency on internal dashboards and reported balances, rather than establishing verifiable performance metrics.

For broader context on how crypto-related scams often present unverifiable profit claims, see: https://www.investopedia.com/crypto-scams-and-how-to-protect-yourself-7119977

Structural Risk Indicators

From a risk assessment perspective, several structural markers stand out:

Recent Registration and Limited Track Record

A domain created in late 2025 has insufficient operational history to establish a credible track record. Scam-style operations frequently register new domains to avoid long-term scrutiny, then abandon them and relaunch under new names once trust is built.

Ambiguous Service Architecture

Effective crypto mining services provide detailed documentation of their technology stack, including hardware types (ASICs or GPUs), hosting environments, uptime guarantees, and payout logic. Without these, users cannot independently verify whether the service is truly mining or merely simulating returns.

Earnings Without Verification

Platforms that display account balances or profitability without third-party verification — such as public mining pool statistics or independent audit reports — rely solely on internal reporting mechanisms. This can create a misleading sense of activity.

Withdrawal Friction Patterns

In many scam-style mining or investment platforms, initial deposits may be accepted easily, but when a user attempts to withdraw funds, additional requirements surface — often in the form of verification fees, minimum trading volumes, or unseen charges.

These mechanics are often flagged in investor-protection resources as warning signs requiring caution.

Deposit and Withdrawal Exposure

The most critical risk for users begins at withdrawal.

In reputable crypto mining services, users should be able to:

• Withdraw mined assets on demand

• View transparent fee schedules

• Understand latency or payout cycles

• Contact support with verifiable resolution paths

If Lion-miner.com’s withdrawal process introduces unexpected charges — such as “network activation fees,” “verification fees,” or “tax withholdings” — these are strong signals of scam-style mechanics. Legit mining platforms provide clear payout rules without contingent payments to release funds.

Why Transparency Matters

When a service involves user funds, especially in unregulated digital asset environments, transparency is essential:

• Public documentation of mining infrastructure

• Independent audit reports

• Clear custodial arrangements

• Regulator disclosures where applicable

Platforms that lack these features expose users to account control risk, loss of funds, and limited recourse in disputes.

Overall Risk Assessment

Based on the combination of:

• Recent domain registration date (November 11, 2025)

• Limited operational transparency

• Absence of verifiable mining infrastructure details

• Promotional emphasis on high returns

• Structural similarities to high-yield scheme mechanics

This Lion-miner.com Review classifies the platform as high-risk and potentially fraudulent. Users should exercise caution and avoid onboarding funds until independent verification of legitimacy is provided.

Report the Scam

➡️ https://www.reportcoinscams.com/book-a-consultation/

If you have experienced blocked withdrawals, unexpected charges, or suspicious activity linked to Lion-miner.com, preserve all transaction records and correspondence before seeking guidance.